The fintech industry has revolutionized the way we manage money, invest, and conduct financial transactions. With the rise of digital banking, mobile wallets, and investment platforms, fintech apps have become an integral part of our daily lives. By 2027, the global digital payments market is expected to reach $12.55 trillion, driven by the increasing adoption of mobile wallets and contactless payment solutions.

However, building a user-friendly fintech app is no small feat. It requires a deep understanding of user needs, robust technology, and a seamless user experience (UX).

In this blog, we’ll explore the biggest challenges in building user-friendly fintech apps and provide actionable solutions to overcome them. Whether you’re a fintech app development company or a business looking to hire fintech app development services, this guide will help you navigate the complexities of creating a successful fintech application.

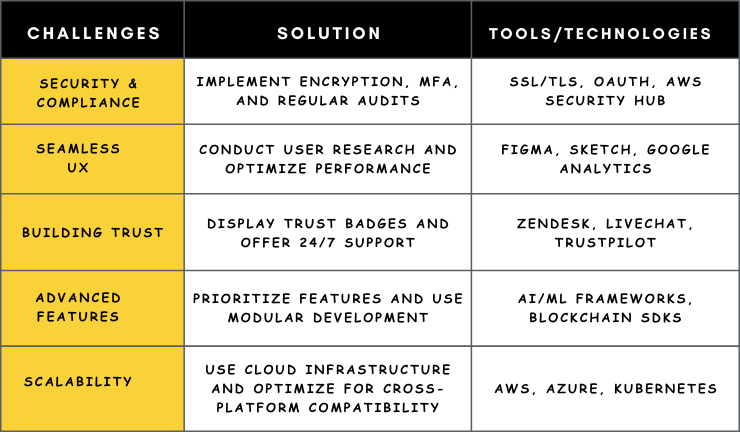

Key Challenges in Fintech App Development

The fintech industry is booming, with innovations like mobile banking, digital wallets, and blockchain reshaping the financial landscape. However, building a fintech app that is both functional and user-friendly is no easy task. Developers and businesses face a myriad of challenges, from ensuring robust security and regulatory compliance to delivering a seamless user experience and integrating advanced features. These hurdles can make or break the success of a fintech app in an increasingly competitive market. In this section, we’ll explore the key challenges in fintech app development and provide actionable strategies to overcome them, ensuring your app not only meets user expectations but also stands out as a trusted and innovative solution.

1. Ensuring Security and Compliance

Fintech applications handle highly sensitive financial information, which makes security an absolute necessity. Users expect their personal and financial information to be protected from breaches, fraud, and cyberattacks. Additionally, fintech apps must comply with strict regulations like GDPR, PCI-DSS, and PSD2.

Challenges:

- Balancing security with user convenience.

- Keeping up with evolving regulatory requirements.

- Preventing data breaches and fraud.

Solutions:

- Implement end-to-end encryption and multi-factor authentication (MFA).

- Regularly update the app to comply with the latest regulations.

- Conduct penetration testing and security audits to identify vulnerabilities.

2. Delivering a Seamless User Experience (UX)

A poorly designed or unintuitive interface can quickly frustrate users and lead to app abandonment. Fintech apps must be intuitive, fast, and easy to navigate, even for non-tech-savvy users.

Challenges:

- Designing a simple yet feature-rich interface.

- Guaranteeing quick loading speeds and seamless performance.

- Catering to diverse user demographics.

Solutions:

- Perform user research to identify and address key pain points and preferences.

- Use a minimalist design with clear calls-to-action (CTAs).

- Optimize the app for performance by reducing load times and improving responsiveness.

3. Building Trust with Users

Trust is critical in fintech. Users need to feel confident that their money and data are safe. Building trust requires transparency, reliability, and excellent customer support.

Challenges:

- Overcoming skepticism about digital financial services.

- Providing transparent fee structures and terms.

- Offering reliable customer support.

Solutions:

- Display security certifications and trust badges prominently.

- Provide clear and concise information about fees and policies.

- Offer 24/7 customer support through multiple channels (chat, email, phone).

Ready to Build your Next Fintech App?

Contact us today and take the first step toward creating a game-changing financial solution.

4. Integrating Advanced Features

Modern fintech apps need to offer advanced features like AI-driven insights, biometric authentication, and blockchain integration. However, integrating these features without compromising usability is a challenge.

Challenges:

- Ensuring compatibility with existing systems.

- Avoiding feature overload that confuses users.

- Maintaining app performance with advanced functionalities.

Solutions:

- Focus on developing features that align with both user demands and tech companies objectives.

- Use modular development to integrate features seamlessly.

- Test the app rigorously to ensure performance isn’t compromised.

The AI in fintech market is projected to grow at a CAGR of 19.7% from 2024 to 2030, highlighting the increasing importance of AI-driven features like chatbots and fraud detection systems.

5. Ensuring Scalability

Fintech apps must handle growing user bases and increasing transaction volumes without crashing or slowing down. Scalability is essential for long-term success.

Challenges:

- Managing high transaction volumes during peak times.

- Scaling infrastructure without downtime.

- Supporting multiple devices and platforms.

Solutions:

- Use cloud-based infrastructure for flexibility and scalability.

- Implement load balancing and auto-scaling mechanisms.

- Optimize the app for cross-platform compatibility.

By 2030, global fintech investments are expected to exceed $1.5 trillion, with a significant focus on scalable solutions that can handle growing user demands.

Why Partner with a Fintech App Development Company?

Building a user-friendly fintech app requires expertise in design, product development, security, and compliance. Partnering with a reputable fintech app development company can help you:

- Leverage industry best practices.

- Save time and resources.

- Ensure your app meets regulatory standards.

- Deliver a seamless user experience.

When choosing fintech app development services, look for a provider with a proven track record, expertise in fintech, and a focus on user-centric design.

Final Thoughts

The fintech industry is booming, but competition is fierce. To stand out, your app must be secure, user-friendly, and feature rich. By addressing the challenges outlined above and partnering with the right fintech app development company, you can create an app that not only meets user expectations but also drives business growth.