As a CFO, having the best accounting skills is just not enough nowadays. A strategic decision-maker, team leader, and advisor who inspires trust needs to be the modern CFO. You need quick access to a summary of your company’s financial data, all in one position, to be successful in any of these positions. On the other hand, to find possibilities and ideas, CFOs and CEOs want further research.

What is a financial reporting dashboard?

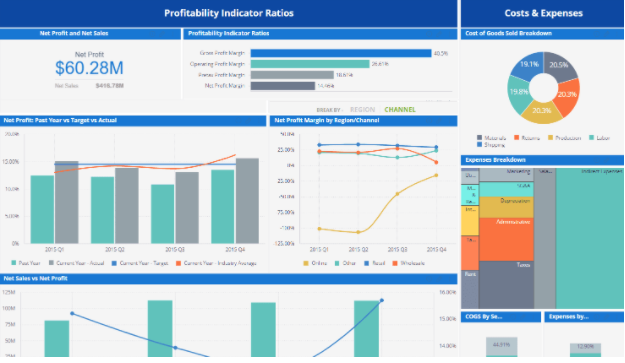

Source: https://www.datapine.com/blog/financial-graphs-and-charts-examples/

A financial dashboard is a management tool that helps monitor all the related finance Key Performance Indicator(KPIs), facilitates successful cash management, and allows a department or company’s financial targets to meet and surpass in detail monitoring expenditures, revenues and profits.

More than ever, financial experts and organizations are under tremendous pressure to provide rapid insights and transparent and accurate financial reports while pushing the business’s performance higher, and having a financial reporting dashboard is the need of the hour.

An organization can easily understand and calculate all the details correctly and in real-time by using financial dashboards. They allow finance experts to more rapidly validate figures and drill as deep as possible into financial information, which improves efficiency and ultimately provides a stable economic climate.

Data at your fingertips, rich options for analysis from one access point, and Key Financial Performance Indicator(KPIs)with integrated intelligent alarms that detect irregularities immediately all provide unlimited possibilities and eradicate repetitive conventional data analysis and reporting methods are all that your dashboard will do!

You can unify all your financial data with modern financial business intelligence and gain immediately actionable insights.

Your Introduction to CFO Dashboards & Reports

The weight of your company’s fiscal well-being most definitely rests on your shoulders as a chief financial officer (CFO). Not only are you responsible for your organization’s ongoing financial plan, but you’re probably expecting to provide many stakeholders with timely, reliable reports.

With so much responsibility and so little time, the analysis of financial data is no simple feat. But, while it was once a massive challenge to work effectively with fiscal data, we live in the digital age and have outstanding solutions available to us. Here is the list of top 6 reasons why real-time financial reporting dashboard software is a boon for CEOs and CFOs.

-

Better Decisions with the Financial Dashboard:

The CFO’s role may have changed by technology, but it can also make your job easier. CFOs will produce more accurate, strategic business decisions through the leverage of emerging technologies with these dashboards.

It can be time-consuming to attempt to produce a detailed report on your own. And several main features are absent from data visualization instruments that come with simple spreadsheet tools. That’s why the new standard for CFOs looking to improve productivity and direct potential strategy is becoming financial dashboards.

A tremendous financial dashboard analyses and compiles the most critical data from different sources in real-time for your business. Here’s how it can help you make better financial decisions with a robust CFO dashboard.

-

Taking the Broad View:

We know you love numbers as a CFO. But getting lost in the weeds can be easy sometimes. You will receive a regular reminder of the larger image from a well-crafted CFO dashboard.

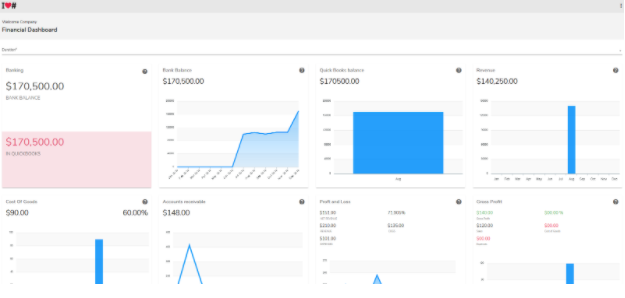

Source: https://www.sisense.com/dashboard-examples/finance/

To serve as financial strategists, modern businesses rely on their CFOs. When you have a comprehensive outlook in mind, you will be better prepared to address the organization’s problems. IRISH is the best option if you want to build your CFO board.

-

Staying Current:

By integrating real-time data from various sources, dashboard reporting will keep you current. An excellent financial dashboard gives you a detailed snapshot of the most up-to-date financial data for your company.

Your business will remain agile when you have a bird’s-eye view of critical metrics. What if, suddenly, your cash on hand starts to fall? With dashboard reporting, rather than being caught off guard at the end of the month, you will be able to take action immediately.

-

Avoiding Uncertainty in Decision-Making:

An overview of the data from your organization is helpful. But analytical power is given by the best data solutions to take advantage of your data.

Not only does data analytics summarize your information, it gives you useful predictions and insights, allowing you to leave uncertainty behind and start making secure, data-driven decisions.

-

Easy to Use:

If that is too hard to use, the new high-tech tool won’t do you any good. A good financial dashboard must have a user-friendly system that enables the business with the most relevant metrics. An easy setup also makes dashboard reporting available, which encourages the communication and coordination of knowledge at all levels of your company, not just with finance experts.

-

Seamless Integration with your favorite Accounting Software

Your organization might be using Quickbooks Online and Offline, Sage, Netsuite, Zoho books, Xero, or any other popular accounting software. Most of these software provides APIs to integrate with 3rd party tools. One can leverage these real-time data points as inputs to generate impactful financial reports using a customized financial reporting dashboard.

Your Introduction to CEO Dashboards & Reports

For any organization to succeed, it needs purpose, direction, and capital to develop and adapt to the surrounding environment, so strong leadership is necessary.

As a CEO, you are responsible for managing every aspect of your business, from the individuals and the internal culture to critical sales, marketing, and financial strategies. Although your organization is undeniably brimming with the kind of talent that can push forward any aspect of your company, eventually, the company’s success rests on your shoulders.

Aside from compassion and personal talents, every influential business leader needs the vision to be the best they can be. And to gain more ideas, with the help of professional real-time financial reporting dashboard software, you need to embrace the power of digital data.

You will gain access to insights with I Love Numbers, and get intelligent online data analysis in the right way, which will help you build strategies that encourage growth and creativity while keeping your workers inspired, active, and satisfied.

Making rough estimates or shooting in the dark will only get you so far in this age. For this purpose, it is essential to gain access to the right combination of tangible insights.

Source: https://in.pinterest.com/pin/630574385347141478/

Benefits of Financial Dashboard

Here are the financial dashboard’s main advantages:

- Data collection and reporting from different data sources

- Provide a single source of data on business finance

- Send automated warnings in the event of an issue

- Simplifying and visually displaying data

- On any device, anywhere, can access it,

- Provide critical financial figures with at-a-glance status

Conclusion:

You cannot afford to miss a beat when it comes to finances. You will minimize costs, raise revenues, and streamline the company’s processes like never before, working with the best tools for the job. The future is now; corporate dashboards are the future.

Contact I Love Numbers and see what we can do for you if you want to power up your financial data analytics with modern solutions. ILN’s data intelligence program also produces pixel-perfect document reports. Reports are especially relevant for dual online and offline use. We customize solutions for you and your business so that you can reach greater heights!

Thanks for sharing such valuable content.

Thanks for sharing the blog.